Nikaalo Prelims Spotlight Important keywords in Budget, Fiscal Policy and Taxation

In other words, the interest rate remains constant for the entire investment tenure irrespective of the fluctuating market rates. Payment of income tax is of prime importance to assess the creditworthiness of a taxpayer. If you are not paying tax on time, it may prove to be a hindrance to your financial activities in many ways. If you are not paying income tax in India, then you are not liable for any tax deduction, as per Chapter VIA, for investments like insurance premiums, medical premiums, etc. If you delay filing an income tax return, then you are liable to pay a penalty of Rs 5000.

Also, there is a high demand for goods and services, and organizations gear ready for rising production in terms of quality and quantity. Expanded government spending, through, regularly on open works, to boost the overall level of employment. Fiscal policy is a way by which the government attempts to control the economy. It is mainly based on notions from John Maynard Keynes, who opposed governments could solidify the business cycle and oversee financial outcomes. Extension of ECLGS till March 2023 is welcome but they expect that the banks should extend the facilities to the most beleaguered micro and small manufacturing enterprises. Rs 6,000 crore over the next five years for a rating tool for the sector creates more fears as 98% of enterprises are proprietary and partnerships .

Conversely, in instances of economic enlargement, the federal government can adopt a contractionary policy, decreasing spending, which decreases mixture demand and the actual GDP, resulting in a decrease in prices. The two main examples of expansionary fiscal policy are tax cuts and elevated authorities spending. Both of these policies are meant to extend aggregate demand whereas contributing to deficits or drawing down of price range surpluses.

In concept, the resulting deficit could be paid for by an expanded economic system during the increase that may comply with. Fiscal policy is the usage of authorities spending and taxation to affect the financial system. Governments use fiscal policy to affect the extent of combination demand within the economic system in an effort to achieve the financial aims of worth stability, full employment, and economic progress. In expansionary fiscal coverage, the federal government spends more cash than it collects via taxes.

To put it simply, the Finance Bill contains provisions on financing the expenditure of the government, and Appropriation Bill specifies the quantum and purpose for withdrawing money. CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law. Central Excise Duty– This tax was payable by the manufacturers who would then shift the tax burden to retailers and wholesalers.

Revenue Deficit

It is the sister technique to monetary coverage via which a central financial institution influences a nation’s cash provide. These two policies are used in various combinations to direct a rustic’s financial objectives. An expansionary fiscal policy looks to incite financial movement by putting more cash into the hand of consumers and organizations. It is one of the significant ways governments react to withdrawals in the business cycle and deter a financial downturn. Clearly, this government is either not interested in genuine macroeconomic revival or persists in the foolish belief that just announcing big capital spending plans can cause people to overlook the actual realities.

What are the problems with using fiscal policy?

Fiscal policy can be swayed by politics and placating voters, which can lead to poor decisions that are not informed by data or economic theory. If monetary policy is not coordinated with a fiscal policy enacted by governments, it can undermine efforts as well.

You shall not copy , distribute , download, display, perform, reproduce, distribute, modify, edit, alter, enhance, broadcast or tamper with in any way or otherwise use any Materials contained in the Website. These restrictions apply in relation to all or part of the Materials on the Website; copy and distribute this information on any other server or modify or re-use text or graphics on this system or another system. You may choose not to create One ID in which case you will not be able to display all your products across ABC Companies on one page. In circumstances like duplicate email id/phone number you may not be able to create the One ID. In such circumstances you must contact the ABCL Affiliate with whom you have held the product/availed the services to enable update the email id/phone number. Once you have created ONE ID you can link and view all your financial products held with ABC Companies on single web page through verification / authentication procedure as applicable to your account/financial products held with the respective ABC Companies. You have the option to withdraw the said consent in the manner specified under these Terms of Use.

The repayment of debts incurred by the government is also done through the Consolidated Fund of India. It is a tax levied by the Government on goods and services and not on the income, profit or disadvantage of fiscal policy revenue of an individual and it can be shifted from one taxpayer to another. That is why an effective solution is to increase consumers’ disposable incomes by a direct injection of investment.

Disadvantages of investing in Government Bonds

But, the very time-consuming procedures of filing tax returns is a taxing task itself. It is a tax levied directly on a taxpayer who pays it to the Government and cannot pass it on to someone else. Tax is a mandatory fee imposed upon individuals or corporations by the Central and the State Government to help build the economy of a country by meeting various public expenses. The government hopes it will make India more appealing to multinational manufacturers that are preferring countries such as Vietnam, Taiwan, Thailand (20%) and Malaysia(24%).

The annual budget is generally supposed to be a statement of not only the Union government’s actual and proposed revenue raising and spending plans, but also of its general economic policy intent. In the field of electronics, Customs duty rates are being calibrated to provide a graded rate structure to facilitate domestic manufacturing of wearable devices, hearable devices and electronic smart meters. Duty concessions are also being given to parts of transformer of mobile phone chargers and camera lens of mobile camera module and certain other items.

- This is completed by decreasing tax charges and by growing authorities spending.

- Instead, by reducing debt and running an excess budget, the company could reduce or even eliminate those costly interest payments.

- Sales Tax– This tax was paid by the retailer, who would then shifts the tax burden to customers by charging sales tax on goods and service.

- If you do not want to share this information with the employer, you are required to pay additional or self-assessment tax.

- One can place the minimum bid through selective websites and mobile applications.

Corporate tax cuts put more money into organizations’ hands, which the government expectations will be put toward new investments and expanding business. In that manner, tax cuts make employment, yet if the organization already has enough money, it might utilize the cut to repurchase stocks or buy new organizations. Thus, this is not the same as an expansionary monetary policy, which depends on giving securities and bringing interest rates all together down to prod loaning concerning banks and enhancing the money supply.

Foreign Direct Investment(FDI) 101: A Complete Guide

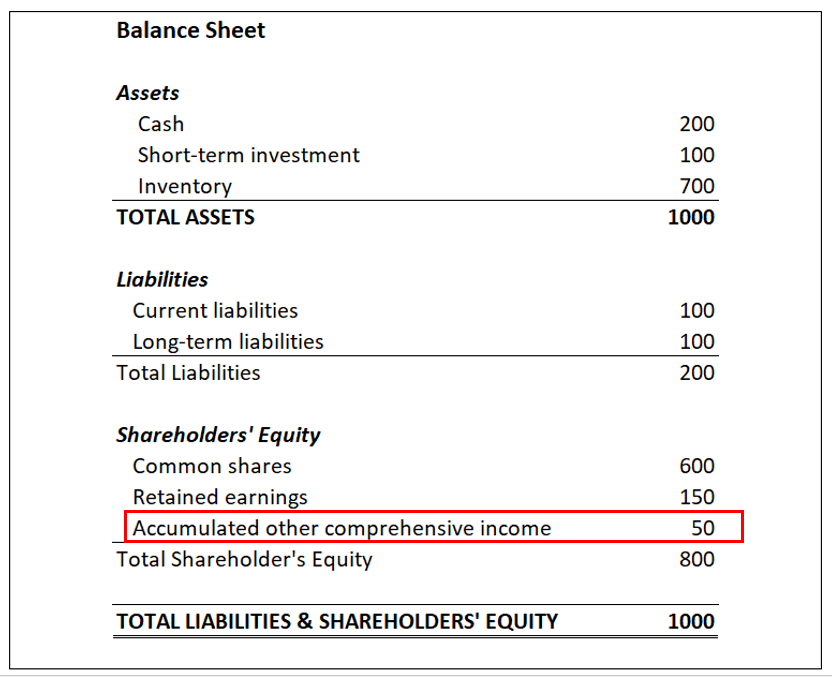

These are largely taxes on expenditure and include Customs, excise and service tax. A revenue deficit, not to be mixed with a fiscal deficit, measures the distinction between the predicted income and the original amount of income. If a company or government has a revenue deficit, its income isn’t sufficient to cover its basic services. When that occurs, it may make up for the revenue it needs to cover by acquiring money or selling existing assets. Income is greater than the expenditure in the same time frame, such as the fiscal year or financial quarter.

What is the disadvantage of monetary policy?

Disadvantages of fiscal and monetary policies

If banks use monetary policy to set interest prices at a low rate, individuals and businesses may borrow excessively, increase demand, and inflate prices unreasonably.

One of RBI’s roles is to serve as banker to both central and state governments. In this capacity, RBI provides temporary support to tide over mismatches in their receipts and payments in the form of ways and means advances. In other words, whereas fiscal deficit indicates borrowing requirement inclusive of interest payment, the primary deficit indicates borrowing requirement exclusive of interest payment (i.e., amount of loan). Primary deficit is defined as afiscal deficit of current year minus interest payments on previous borrowings. Revenue deficit arises when the government’srevenue expenditure exceeds the total revenue receipts.

Pros & Cons of Corporate Tax Rate Cut | Good Move or Bad Move?

Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. Income Tax- It is imposed on an individual who falls under the different tax brackets based on their earnings or revenue and they have to file an income tax return every year after which they will either need to pay the tax or be eligible for a tax refund. So, there might be possibility of using the increased earnings of the corporates in repayment of their existing debts instead of more investments. In order to cater the widened fiscal deficit, there might be a constraint on government spending. A cloud of questions hovers above the real impact of the corporate tax rate cut announced by the Indian government.

There is a cyber-fraud every day draining the hard-earned savings of lakhs of persons hurting their livelihoods as well. Waste management has no incentive and de-carbonisation too was little talked about. It seems that the Narendra Modi government has decided, in an election year, that general elections can be fought and won without efforts to improve the material conditions of the bulk of the people, and even simply ignoring their suffering. Exemption is also being rationalised on implements and tools for agri-sector which are manufactured in India. Customs duty exemption given to steel scrap last year is being extended for another year.

No deduction in respect of any expenditure or allowance shall be allowed while computing such income except cost of acquisition. Further, loss from transfer of virtual digital asset cannot be set off against any other income. In order to capture the transaction details, a provision has been made for TDS on payment made in relation to transfer of virtual digital asset at the rate of 1 per cent of such consideration above a monetary threshold. Gift of virtual digital asset is also proposed to be taxed in the hands of the recipient.

What is fiscal policy and its importance?

Mobile-based solution for small business owners and their customers to enable recording of credit/payment transactions digitally across the country. According to income tax rules and laws, each individual can avail tax benefit of standard deduction of Rs.40,000 if your annual income is Rs.540,000. After the standard deduction, you have to pay tax only for an annual income of Rs.500,000. You may share other income details with the employer if you wish to; it will help the employer to determine TDS accurately.

![]()

Have a look at the options available to the government if they can achieve a surplus on their budget. Additionally, it may decide to use Surplus to finance and start new programmes. 24 years old Early Childhood (Pre-Primary School) Teacher Charlie from Cold Lake, has several hobbies and interests including music-keyboard, forex, investment, bitcoin, cryptocurrency and butterfly watching. Is quite excited in particular about touring Durham Castle and Cathedral. Fiscal measures may introduce delay, uncertainties and arbitrariness arising from administrative bottlenecks.

This Website makes no representations or warranties as to the fairness, completeness or accuracy of Information. There is no commitment to update or correct any information that appears on the Internet or on this Website. Information is supplied upon the condition that the persons receiving the same will make their own determination as to its suitability for their purposes prior to use or in connection with the making of any decision. Neither ABCL and ABC Companies, nor their officers, employees or agents shall be liable for any loss, damage or expense arising out of any access to, use of, or reliance upon, this Website or the information, or any website linked to this Website.

Thus we can see that it is very much expedient that fiscal deficit doesn’t cross the safe limits and even if it crosses, it must be brought back as soon as possible. Contractionary fiscal policy includes reducing government spending, growing taxes, or a combination of the 2 so as to decrease mixture demand and gradual financial progress to reduce inflation. Expansionary fiscal policy, therefore, attempts to repair a lower in demand by giving shoppers tax cuts and other incentives to increase their buying power .

This can be quite an interesting topic to learn about, especially if you’re attracted to learning about financial concepts. This is also a fundamental concept that would be studied during your 11th and 12th economics classes. We will learn the definition of deficit in revenue, the formula and how to solve any question you’ve been given, the disadvantages of deficit. You will see a solved example, examples of deficits, and learn many other concepts. You will also learn about the fiscal deficit, revenue deficit, the difference, and much more. Vedantu helps you to answer fundamental questions such as “what is revenue deficit?

The economic system has entered a slowdown that has now became a full-blown recession. Contractionary fiscal policy results in a smaller authorities price range deficit or a bigger budget surplus. Sacramento can achieve this by either increasing taxes, reducing its government expenditures or each. This will reduce the budget deficit, lower progress fee, decrease inflation and enhance unemployment price. Fiscal policy is based on the theories of British economist John Maynard Keynes.

What is the disadvantage of expansionary monetary policy?

Disadvantages of Expansionary Monetary Policy

Consumption and investment are not solely dependent on interest rates. If the interest rate is very low, it cannot be reduced more, thus making this tool ineffective. The main problem of monetary policy is time lag which comes into effect after several months.